Third and final article of our WIRE special edition focusing on Residential Mortgage Backed Securities (RMBS). Having gone through the key characteristics of RMBS notes and some of the key technical terms, we are looking now at how these notes have generally performed over time. Given hundreds of series of notes have been issued over the years, we have limited our focus on tranches that our clients have purchased and are still outstanding. The oldest transaction was issued in 2012 by AMP Bank and we currently have in our custody 143 different series of RMBS and Asset Backed Securities (ABS) notes with a total issued amount in excess of AUD1.5bn.

1. Rating performance

Credit ratings are designed to provide a relative indication of risks based on a theoretical stress scenario. The highest rating, AAA, is assigned to securities that are expected to survive the harshest of stress scenarios. At the other hand of the spectrum, a rating of B would only survive a modest stress environment. As it has been well reported, credit rating agencies faced significant heat as a result of many structured finance transactions defaulting during the GFC, even though their ratings implied they would have survived (as an aside, these securities were issued primarily in the US and significantly more complex than the RMBS or ABS securities we have been discussing in this edition of the Wire).

As a result of the GFC, credit rating agencies have fundamentally revised their rating methodologies to ensure they are a lot more robust and can stand up to scrutiny a lot better. In practice, credit rating agencies have taken a far more conservative approach and it is widely accepted that RMBS ratings incorporate a certain level of conservatism compared to ratings issued for corporates or financial institutions.

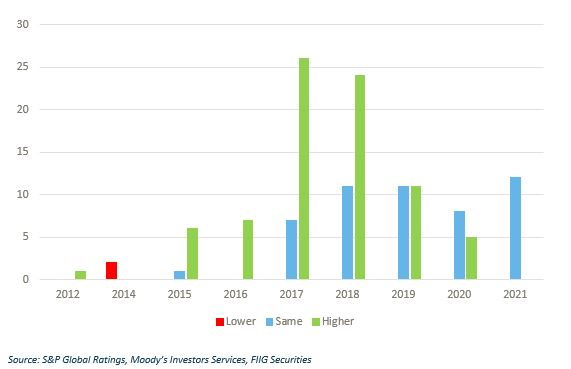

The graph below shows, for all the rated notes we have in our custody, how their current ratings are compared to where the same notes were rated on issue. Of these 132 series, only two have a rating now that is lower than the initial rating. These two series (Torrens 2014-1 and Progress 2014-1) were issued in 2014 and are currently rated only one notch lower than their original rating.

The Torrens transaction was downgraded in late 2014 as a result of the downgrade of Genworth Financial Mortgage Insurance, i.e. the downgrade didn’t reflect the performance of the underlying mortgage loan portfolio. The Progress transaction was downgraded in 2018 mainly because of its reducing size (which increases the mortgage loan concentration), with the current rating aligned to the rating of the lenders’ mortgage insurers that effectively support this transaction.

Other than these two transactions, the remaining 130 are currently rated at or above their initial rating, which talks to a very strong performance across the asset class (but also our thorough selection process).

2. Principal amortisation

As we discussed in the second article, RMBS transactions are structured to initially have the most senior tranche receive all the principal repayments and, provided certain tests are met, then principal repayments will be allocated on a pro-rata basis. These tests that determine this change in payment allocation are effectively a proxy for performance against expectation. If a test is not met, it could be because the transaction doesn’t perform as expected.

There are generally three triggers:

- The payment date has to be at least two years after the issue date – this clearly is independent of performance;

- The credit support for the most senior tranche should be more than a pre-determined level – this is partly tied to performance;

- Arrears should be below a certain threshold – completely tied to performance.

Taking the second test above, there are generally two reasons this test is not met: 1) the speed at which underlying mortgages are prepaid early is lower than originally anticipated, or 2) there is a relatively high level of default. In our experience, the second scenario is highly unlikely and would happen only if high arrears have been previously observed. We note that the level of losses on Australian RMBS remains extremely low and have generally been covered by a combination of claims on lenders’ mortgage insurance and excess spread.

Of the 143 series of notes in our custody (132 rated and discussed above, as well as an additional 11 that are unrated), 85 notes are receiving ongoing amortisation, meaning they are supporting transactions that are performing at least in line with original expectation. Of the remaining 58, 32 were issued less than two years ago (meaning that, irrespective of performance, they wouldn’t be eligible for amortisation), and four were structured not to receive any ongoing amortisation (rare but some are structured that way). Which leaves only 22 transactions, with all but one not paying principal on a pro rata basis because the level of support for the most senior tranche is yet to achieve the required level (but expected to in the near future).

Only one transaction does not allocate principal to all tranches because arrears are above the required threshold. This is the Sapphire 2018-2 transaction, sponsored by Bluestone, a non-bank finance company specialised in non-conforming mortgages. This particular transaction is currently experiencing 90+day arrears of about 11%, against a threshold for pro-rata amortisation of 8%. But it is important to put this into context. Since the transaction was originally issued in September 2018, properties backing AUD5.3m of loans have been foreclosed (against an original transaction of AUD300m), suffering losses marginally below 15%. This represents about 0.25% of the original issue amount and these losses have been entirely covered by excess spreads, with all tranches unaffected.

3. Conclusion

The above two reference points are only two of many areas that can be closely scrutinised when assessing if a RMBS transaction is performing to expectations or not. Other areas that are good to follow include how arrears evolve over time, how the weighted average loan to value ratio decreases over time, net losses on foreclosed loans (where relevant). In fact, monthly reports are generated that provide a lot of granular information on the underlying portfolio, which provides sufficient indication to determine if the loans are behaving in line, better or worse than expected. While over the last few years, the residential housing loan market has experienced ups and downs (all within reason), the performance of Australian RMBS transaction has remained very solid and demonstrates the robustness of these structures.